USAA began in 1922 with 25 Army officers who offered to insure each other’s vehicles when no one else would. Their small organization has grown into a respected institution offering a full range of financial products to 9.8 million members. And their product set is incredibly diverse. Also, the 2013 Temkin Group Customer Experience Ratings showed that USAA was the top insurance carrier with a rating of 50% higher than the bottom carrier, and Satmetrix® reported them as the “top-ranked company in annual Net Promoter Index of customer loyalty (2009-2012)”.

At a very high level, it appears that USAA has become so diverse and excellent at creating incredible member experiences because they focus on serving military members. Consider this scenario:

In a family of two parents and two kids, one parent is stationed at an outpost in Afghanistan, and the other is on a missile submarine on a 3-month submerged deployment. The kids stay with one set of grandparents, who are retired military. Everyone has their financial business with USAA. The parents can have questions or need changes anytime they get a break in the action and can access an Internet phone. The grandparents have oversight responsibility for the financials and are doing their best. With this kind of scenario, is it any wonder that USAA had to figure out how to take great care of its members and offer many value-added services to provide reasonable peace of mind?

USAA’s Services

USAA segments its portfolio of products and services into seven segments. Here is one interesting “product” in each category:

- Insurance – Annuities

- Banking – Credit monitoring

- Investing – College savings

- Real Estate – Real estate agent finder

- Retirement Planning – Wealth management

- Health Insurance – Medicare

- Shopping and Discounts – Car and jewelry buying service

Let’s dig deeper into just one of these areas;

What is Home Circle™?

Home Circle puts search tools, guidance, and products at your fingertips to meet all your real estate needs:

- Powerful tools. Search comprehensive real estate listings — and get information on area schools, shopping, and dining.

- Organize your search. Save your favorite searches and get driving directions to properties. Plus, you can use your iPhone® or Android™ device to upload photos and notes on properties you visit.

- Find a real estate agent and save. Get a cash bonus of up to $3,100 when you buy and sell your home through our MoversAdvantage program.

- Make closing day easy. USAA’s title company, United Lender Services (ULS), can ensure your closing fits your needs while providing you with the same world-class service you expect from USAA. Talk with your MoversAdvantage real estate agent about using ULS.

- One-stop shopping for all your real estate needs: Real Estate Agent Finder

- Homeowners Insurance

- Renters Insurance

- Valuable Personal Property

- Mobile Home Insurance

- Home Value Monitoring

- Life Insurance

- Rental Property Insurance

- Mortgage

- Flood Insurance

- Condo Insurance

- Home Equity

- ADT Home Security Systems

- USAA MemberShop

- Find a Professional Contractor

- Utility Marketplace

All these services are available over the web or by telephone 24×7.

Financials

Here is an extract from the USAA.com Financial Strengths page:

USAA is classified as the U.S.:

- 26th largest bank

- 5th largest homeowners insurer

- 8th largest credit card provider

- 6th largest auto insurer

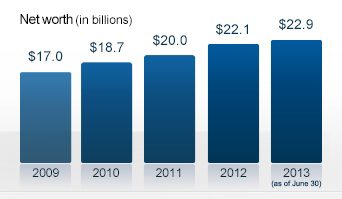

- and USAA ranks 58th in net worth among Fortune 500 and 139th for revenue

This company is a financial giant. The members love them and are incredibly loyal to USAA. This is a company to emulate, but, unfortunately, they have a unique advantage over most of us – their customers are and have risked their lives for our country and expect and demand respect, professionalism, and integrity in all their dealings.

Can we deliver these kinds of experiences to our client/customer base? We had better since USAA customers are also our customers!

About Middlesex Consulting

Middlesex Consulting is an experienced team of professionals with the primary goal of helping capital equipment companies create more value for their clients and stakeholders. Middlesex Consulting continues to provide superior solutions to meet the needs of its clients by focusing on our strengths in Services, Manufacturing, Customer Experience, and Engineering. If you want to learn more about how we can help your organization begin to create value-added services, please contact us or check out some of our free articles and white papers here.